FUNDS AND THE ENDOWMENT

Your gift will help initiatives in greatest need of your immediate support, or you may choose to designate your gift to one of the following options:

PLS Foundation Endowment

By donating to the endowment, your gift can help support literacy into perpetuity. Each year, your gift will accrue interest to spend on current and future projects.

Love my Library

You can direct gifts to support programs at your local library branch.

System-wide Literacy Programming

You can help support educational experiences and even give books to children.

Summer Learning Challenge

Support reading programs for children, teens, and adults at all PLS libraries.

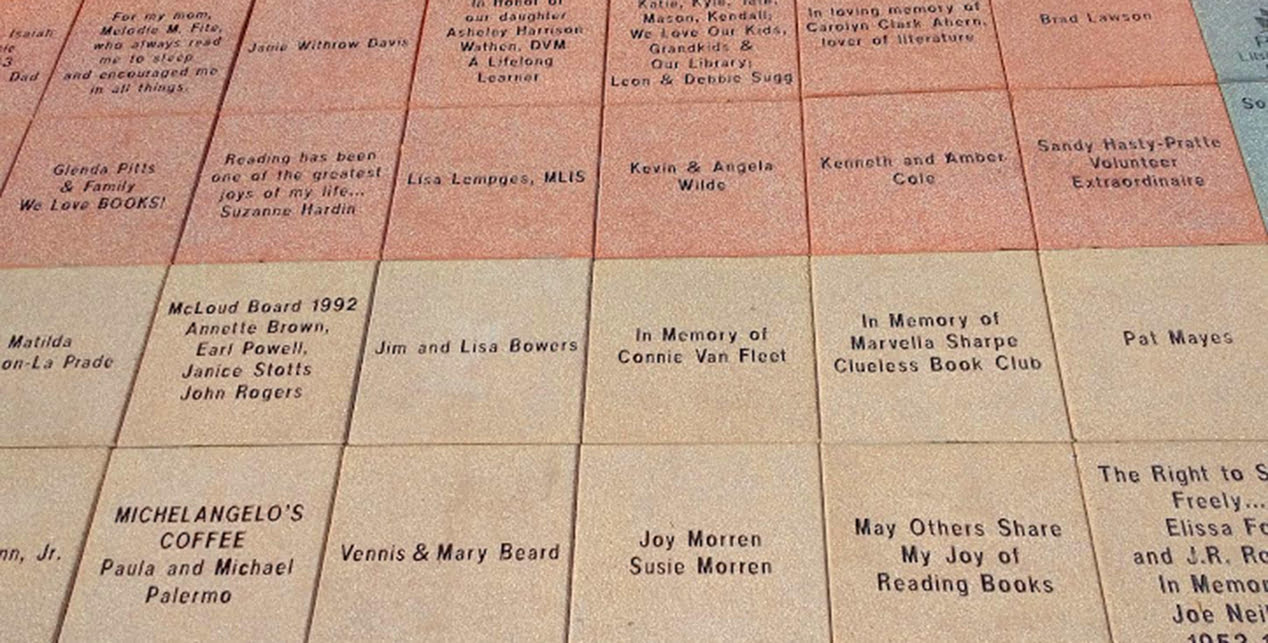

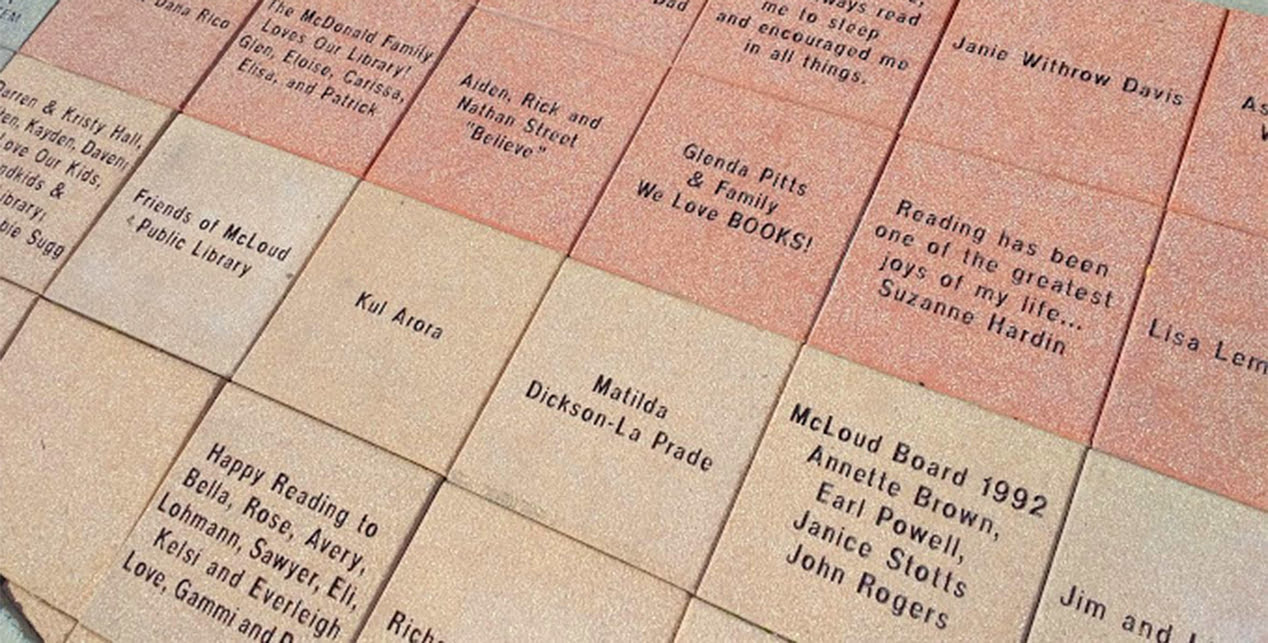

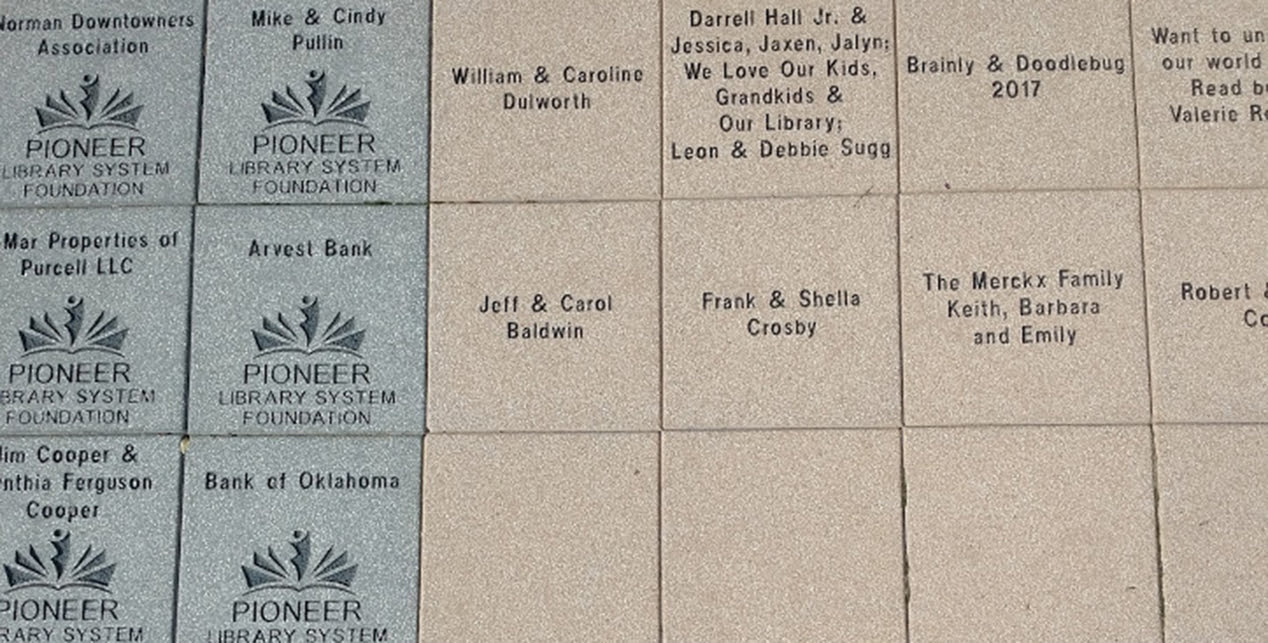

Purchase a Paver

For a $250 unrestricted gift, you can become a part of Pioneer history! We will engrave a cement paver for you to display in front of the Pioneer Administration Building adjacent to Norman Public Library West.

CREATE YOUR LEGACY

You can create your own legacy by including Pioneer Library System Foundation in your will or estate plan.

CHARITABLE BEQUESTS

A charitable bequest is a great way to take care of yourself and your library. Working with your attorney or financial advisor, you can provide specific instructions in your will or living trust – usually just a few sentences. You can leave the Pioneer Library System Foundation a specific item, amount of money, or percentage of your estate.

LIFE INSURANCE AND RETIREMENT

You may also support the library by naming the Pioneer Library System Foundation as a beneficiary of a life insurance policy or retirement account.

When naming the library as a beneficiary, please indicate the beneficiary name as:

Legal Name: Pioneer Library System Foundation

Mailing Address: PO Box 721738, Norman, OK 73072

Federal Tax ID: 01-0945757

TAX ADVANTAGES

Gifts payable to a charity upon a donor’s passing, such as a bequest, life insurance policy, or retirement account are exempt from estate tax. Additionally, donors contributing appreciated property, like securities or real estate, receive a charitable deduction for the full market value of the asset and pay no capital gains tax on the transfer.

PIONEER SOCIETY

If you make a planned gift, you also receive membership into the Pioneer Society. For information on member benefits, click here.

If you would like more information, please contact us at (405) 801-4521.